Asset allocation strategy during market volatility : Expert views for investors

- By MultiSphere

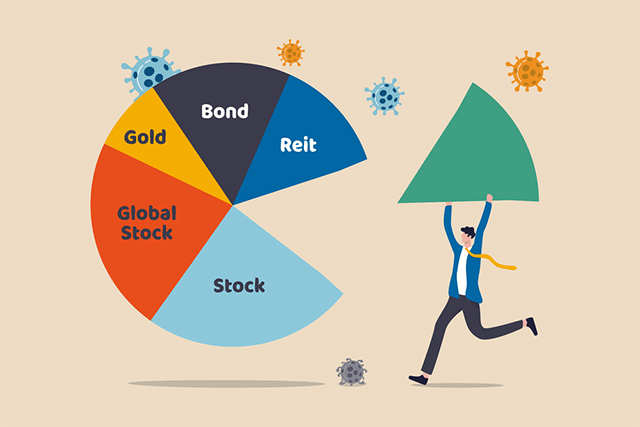

Stock markets are volatile by nature which tends to make investors nervous about their exposure to one asset class, especially equity. To get your asset allocation formula right at all times, it is important for investors to understand their risk appetite and choose the right strategy to build wealth in the long term.

Diversification plays a key role in your financial planning. We asked Chirag Mehta, Senior Fund Manager – Alternative Investments, Quantum AMC if there is a thumb rule for diversification to achieve financial goals in the long term.

“Diversification helps in balancing out the risks and returns to achieve adequate returns at the same time minimizing the risk for increasing the probability to get the return an investor is looking for,” he said during an exclusive session conducted by Economic Times to address investor concerns amidst market volatility.

Chirag Mehta also shared a tried and tested Asset Allocation Rule of 12:20:80 that works across market cycles and that investors should adopt while investing in mutual funds to mitigate risk.

“Asset Allocation Rule of 12:20:80 refers to 12 months of expenses kept aside for emergencies like job loss or loss in business or a medical emergency. The rest of the money needs to be split 80:20 which means 80 percent to be invested in equities and 20 percent in gold assets. Gold acts as a diversifier and adds stability to your portfolio,” adds Mehta.

Maintaining a good balance between asset classes that have appreciated too much and those that have not performed well in the short term is crucial. For investors to set the asset allocation right, it’s important to understand the characteristics of each asset class. “Investors should stick to their objectives while diversifying into different assets like equity, debt, and gold. Since asset allocation is for the long term, short-term volatility should not affect your portfolio,” feels Anup Bansal.

On factors that play a crucial role in rebalancing and monitoring the portfolio, Kaustubh Belapurkar, Director – Fund Research, Morningstar India says, “Rebalancing is within a strategic limit depending on investor’s needs and market conditions. From 80 percent, the equity allocation can come down by a few percentage points but never zero, this has to be remembered.

Gold can be a great diversifier provided investors have it in their portfolio at all times, not just when it’s performing. You have to stick to your thesis and keep rebalancing the portfolio within a confined (bracket) rather than trying to make it zero or one as it’s always about modulating the exposure where you see pockets of overvaluation and undervaluation.”

Source: Economic Times

Connect with us and FREE recommendation!

Mutual Fund

Insurance

More Investments

SIP